News

Joint insolvency practitioners appointed to Laragh House Developments Ltd

A CVL is an insolvent liquidation process initiated by shareholders or directors

Insolvency specialists from Price Bailey have been appointed to Laragh House Developments Ltd after the company entered into a voluntary creditors’ liquidation. Simon William Somerville Large, the sole remaining director and founder, called a creditors meeting for his company, Laragh House Developments Ltd.

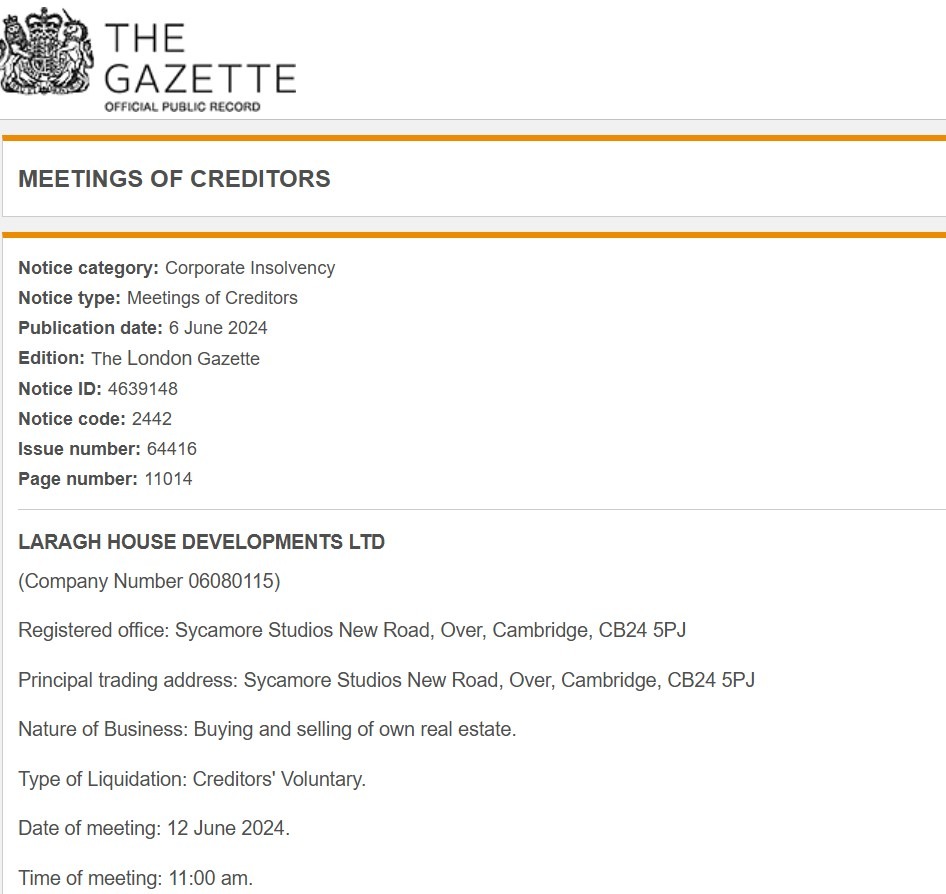

Notice of the meeting was advertised in the London Gazette, the official register related to insolvency.

It was described as a ‘creditors’ voluntary liquidation’ which occurs when a company is unable to pay its debts and creditors then become involved in its liquidation.

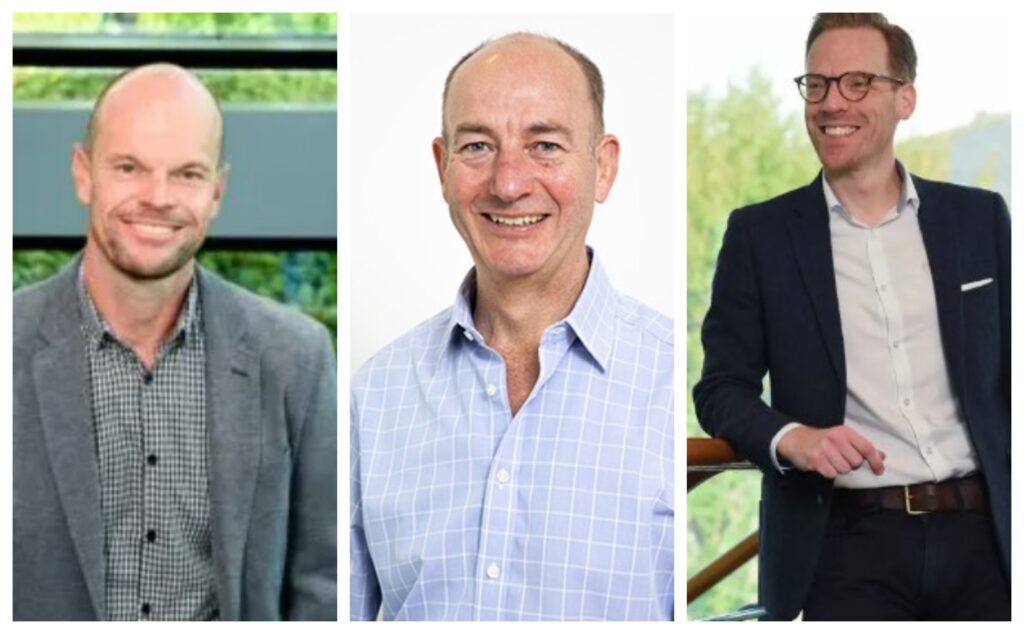

The meeting took place on June 12 following which creditors agreed to the appointment of Matt Howard and Stuart Morton, both of Price Bailey LLP in Norwich, as joint insolvency practitioners.

Although Mr Somerville Large is shown at Companies House as being the only remaining director, ownership of Laragh House Developments Ltd was split with Houghton Homes of Cambridge.

In 2020 Laragh Homes announced a Cambridge collaboration with Houghton Homes Ltd with the latter at the time making a “significant investment” into the company with the promise of providing “new funding to help drive forward the major development programme already in place at Laragh”.

Houghton’s founder Andrew Houghton joined the board of Laragh House Developments Ltd on June 30, 2020, but Companies House records show he resigned as a director on June 7 last year.

In January of this year Hannah Greenhow is shown on Companies House records as resigning as sales and marketing director, the same month Fiona Somerville-Large resigned as company secretary. Fiona was a founding partner of Laragh in 2007.

Companies House record, Laragh House Developments Ltd

And on March 31 this year Caroline Chapman, who had been finance director since 2016, resigned.

There are other companies within the Laragh portfolio, and it is not clear how these have been affected by the voluntary creditors liquidation of Laragh House Developments Ltd.

Mr Howard told CambsNews he expected further details from the creditors’ meeting to be publicly available via the Companies House website shortly.

The meeting heard that the registered office and principal trading address of Laragh House Developments Ltd is Sycamore Studios New Road, Over, Cambridge, CB24 5PJ

The last accounts filed for Laragh House Developments Ltd (for the year ending July 31, 2022) showed cash at bank in hand of £5,563 compared to £66,570 the previous year.

The accounts also creditors falling due within one year of £2.066m, more than double that of the previous year.

Number employees for the year was given as 9, against 6 in the previous year.

Available at the meeting on June 12 was a list of names and addresses of the company’s creditors.

Creditors were entitled to attend and vote at the virtual meeting which resulted in the appointment of Price Bailey.

Price Bailey advertises that its “experienced team of insolvency and recovery practitioners are ready with the professional advice and guidance you need, and when recovery is not feasible we can advise and assist with the most appropriate solution depending on the circumstances and desired outcome”.

London Gazette notice re Laragh House Developments Ltd

It adds that for insolvent companies, there are two main liquidation processes that companies undergo – Creditors Voluntary Liquidation (CVL) or Compulsory Liquidation.

“Our focus is always on recovery and not burial, and we will conduct a thorough assessment of your business and your situation to analyse whether recovery may be possible,” says their mission statement.

“If recovery is not possible, and you haven’t been forced into liquidation by your creditors, then CVL is often the most valuable process for all parties involved.”

“A CVL is an insolvent liquidation process initiated by the shareholders or directors of a company, rather than their creditors.

“This process involves a licensed Insolvency Practitioner to act as a liquidator for the company. The liquidator will then realise all of the company’s assets and distribute the maximum return to creditors and shareholders in order of priority set down by law.

Insolvency will be a bitter blow to the hopes and aspirations of the Stretham and Wilburton Community Land Trust.

Matt Howard (left) head of insolvency and recovery at Price Bailey and (right) Stuart Morton, a Price Bailey partner and insolvency practitioner. Centre is Simon Somerville-Large, founder and sole director of Laragh House Developments Ltd.

Their joint application with Laragh House Developments Ltd to build 115 homes on a 45-acre site known as Camps Field, Wilburton, was finally abandoned earlier this year after failing to satisfy East Cambridgeshire District Council planners it remained viable.

The scheme has been widely criticised for its lack of community support and is currently subject to an investigation by the Cambridgeshire and Peterborough Combined Authority over purported backing for it.

This is a developing story ….