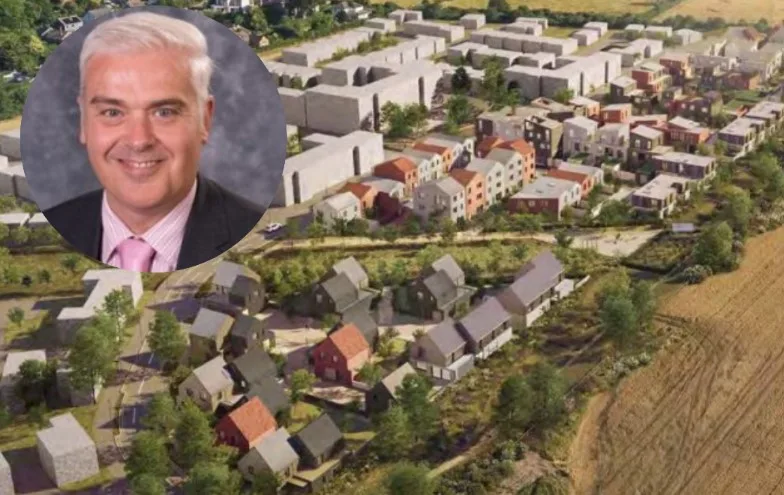

It looked a marriage made in heaven but in reality another proverb, act in haste repent at leisure, is probably more apt for the debacle over the aborted sale of Shire Hall, Cambridge, to developers Brookgate for a 255-room hotel. The company that four years ago beat 30 others to secure a deal with Cambridgeshire County Council for the lease of the six-acre Shire Hall site in Central Cambridge, has pulled the plug on the deal.

They did so, as we learnt today, shortly before the August 14, 2023, deadline set by the strategy and resources committee for signing.

“Brookgate contacted the council to advise that following detailed consideration of the deal by their board, they were unable to proceed on the agreed terms,” chirps the county council finance chief Michael Hudson.

The lease included the Castle Mound and the Civil War Earthworks, the site’s major heritage assets. Brookgate had assured the council they would protect and enhance access to them.

In the summer, CambsNews reported that nearly £100,000 a year is being spent by Cambridgeshire County Council on security on their former headquarters at Shire Hall, Cambridge.

But that only reflects part of the cost.

The strategy and resources committee was told that an overspend of £1.5m on the property service budget last year “is partly due to the continued cost of running the old Shire Hall site, £424k.

Brookgate, the company which was responsible for the CB1 development among other Cambridge projects, had proposed converting Shire Hall into an upmarket hotel and office space whilst continuing to allow public access to the Castle Mound and Civil War Earthworks.

Cambridgeshire County Council hoped a quick sale of Shire Hall would reap savings as they moved to a slimmed down, new headquarters at Alconbury.

Tory leader at the time, Cllr Steve Count, felt the deal with Brookgate “looks likely to exceed figures outlined in our business case, and see the value of our asset enhanced, but still retain ownership of the site for future generations – which strengthens our original decision to vacate the site”.

As I reported in January, the council had promised savings of up to £39m over 30 years when the decision was made in 2018 to leave Shire Hall and move to new purpose-built offices at Alconbury.

But despite agreeing to lease a major chunk of Shire Hall to Brookgate, it became an expensive ‘elephant in the room’ for county councillors who grew increasingly alarmed by the financial quandary the lease created.

Ahead of the strategy and resources committee in January, confidential briefings were provided to all group leaders but the public and press was excluded from subsequent debate.

Council leader Lucy Nethsingha told me that the move from Shire Hall was not something that would have happened under a Labour/Lib Dem/Ind coalition.

“And the decision about the future of Shire Hall would not have been made in way it was made and certainly the plans for Shire Hall are not the ones we would have chosen,” she said.

That may be the case, but the reality is that Cllr Nethsingha and the ‘rainbow alliance’ were stuck with decisions made prior to their electoral success in 2021.

Mr Hudson is now offering us a glimpse of what happens in a paper to the assets and procurement committee next week – even though a trio of appendices are marked ‘confidential’, so we only have an outline of what is happening.

We do learn that a new marketing campaign to find someone, somewhere willing to ‘buy’ Shire Hall is being recommended.

And Mr Hudson expects a less painful period ahead of negotiations since much of the legal paraphernalia connected with a sale has been completed.

He even talks of “defined deadlines for exchange and completion of contracts” once a new buyer is found.

In fairness, Mr Hudson says, circumstances have changed since 2019 “due to the significant economic impact of the COVID pandemic, in particular material and labour cost inflation and supply chain uncertainty”.

And in January, during the confidential session of the committee, he confides that “a further update and amendment to terms was approved following the impact of the Government’s emergency budget that drove a rapid rise in interest rates and gilt yields. 50-year gilt rates had risen from around 1.16% at the start of detailed negotiations (November 2019) to their current level (October 2023) of 4.56 %, impacting both finance costs and development values for the scheme”.

He also says overall construction costs have increased by 24% from 2019 to September 2023.

But despite these uncertainties “legal negotiations were in their final stages with few significant outstanding points of contention” before Brookgate pulled out.

Mr Hudson can at least find a bright spot, telling councillors that because of the delays a “huge volume” of redundant and surplus furniture at Shire Hall has been sold and generated an income as opposed to being sent to landfill.

Charts showing the costs of keeping Shire Hall unoccupied will be shown to the committee, and Mr Hudson points out the car parks continue to offer an income.

“Property Services has also invested in improving signage and facilities in the car parks to increase usage and support the city centre,” he says.

“It has also invested in the heritage interpretation and amenity of the site, with brand new heritage information boards and increased litter bins and litter picking to improve visitor experience.”

So, all it’s not all bad news.

To other costs he says the annual saving is over £850k per annum and reducing although the spend on professional advisers, BNP Paribas as property consultants and agents, and Pinsent Mason solicitors is £173,000.

Mr Hudson says the council obtained advice from Pinsent Masons on the available options for developing the site.

For the council to have maximum controls over the delivery of the scheme would require a full procurement process for the appointment of a developer (as it would constitute a public works contract).

This, he says, would be expensive and take a significant amount of time.

“Instead, advice remains that approaching the market to offer a land transaction, with the potential for CCC to take an income strip lease, is still the most beneficial option,” says Mr Hudson.

The detailed advice will be in exempt papers and Mr Hudson says each option has been ranked and based on projected values.

Most valuable options

The analysis, he says, confirms that development of the site involving offices and hotel uses remain the most valuable options for developers.

However, the committee will need to agree precisely how that will work in practice since one option, to rent to an international brand such as Hilton or Accor, “carries a high degree of management cost and commercial risk as the council is taking on the room vacancy risk for the hotel – the income assumes suitable levels of occupancy in the hotel.

“If this declines then the council’s income will decline and could go into loss in extreme events (e.g. 9/11, COVID etc).

“This is a similar operation to that operated by CCC at Brunswick House, noting that student letting are longer term and less fluid and seasonal than hotel bookings.

“The council will need to ensure that it has suitable management and professional expertise to oversee and manage the hotel operator and ensure overall hotel performance”.

Refurbishing both Shire Hall and the Octagon as high-quality offices is the next best option, but significantly exposes the council as a landlord in the Cambridge office market.

“The original scheme of a leased hotel and offices remains financially attractive and provides some diversity of risk across two property sectors (hotel and office),” says Mr Hudson.

“Student accommodation is also viable, and demand remains stable in Cambridge, however the council already has significant commercial exposure to this sector through its operation of Brunswick House and the lease to Collegiate at Castle Court, Cambridge.”

He also says “senior living does not achieve the minimum residual site value of £6m considered necessary for any scheme to be considered viable for the council.

“It is also a highly specialised market, and various factors such as the site being located at the top of a long hill above the main shopping area may limit interest in this use,” he says.

The Income Strip principle, which he favours, means that the county council retain the freehold ownership of the site in the long term, with a developer obtaining planning consent and redeveloping the site with funding from an external funder.

Upon completion the council pays rent to the funder for the agreed lease term (50 years is proposed), whilst the council is paid rent by the tenants of the site e.g. office occupiers, hotel operator etc.

“This generates a net profit,” says Mr Hudson.

Other options for the disposal or redevelopment of the Shire Hall site area include a freehold sale, long leasehold disposal, CCC undertaking planning only, CCC undertaking the development itself of the site or self-managed hotel:

“A freehold sale is the outright sale of the site to a third party for them to develop or use the site as they deem appropriate,” says Mr Hudson.

“This would produce a capital receipt, likely to be in the range of £10m to £15m but will end the council’s involvement in the site.

“Due to the high-profile nature of the site a buyer may pay a premium above the quoted price range, in part depending upon perceived market conditions.

“It is the quickest and simplest method of disposal.

“A long leasehold disposal in this scenario the site would be sold for an initial capital receipt and a long-term rental income.”

Commercial risk threat

Mr Hudson is emphatic that if the county council were to go ahead with self-development of the site – and take any profit from it accordingly -it would also face the commercial risk.

“This level of risk is not considered appropriate for the council, and it would require a dedicated and specialist team to manage the redevelopment,” he says.

“The self-development route would also require the council to find around £100m of development funding, something that would be challenging and impose risks on wider council finances.

“We do not consider it would be straightforward to include such a scheme in the county council’s capital programme and remain in compliance with the PWLB (Public Sector Loans Board) stipulations which prohibit capital investment in assets primarily for yield.

“Challenges with construction costs or delays beyond contingencies could see the council facing multimillion cost overruns and this is an area that has directly impacted some other councils who have engaged in direct development activity.

“Whilst this method of delivery has the potential for the high returns it also carries the highest commercial and financial risk and would require significant internal council management and professional input over a protracted period of time.”

Mr Hudson says: “The council does not currently have sufficient headroom in its own capital programme (given competing requirements) to fund the development itself and would likely face regulatory barriers to accessing PWLB lending were it to pursue this route (whether it was funded by borrowing or otherwise).

“Additionally, although there is a potential reward in retaining all future revenues, there are cautionary considerations as to whether the additional delivery and construction risks should be taken on by the council, even if financing was available.”

Marketing campaign for Shire Hall

It is likely the committee will agree to prepare a marketing campaign for the Shire Hall site to launch early in the New Year “with a clear timetable for the process through to legal completion.

“A deadline for legal completion would be expected to be set for the Summer of 2024.

“The marketing process will offer the site on an ‘open’ basis for developers and bidders, noting the council’s requirement to seek ‘best consideration’ and the ability of a successful developer or bidder to complete legally binding contracts and the development.

“Whilst the council will not impose specific requirements on developers or bidders, there will be a preference for retaining ownership and a long-term income”.

The evaluation of bids and selection of a preferred developer or bidder is expected to take place in March or April 2024, with conditional exchange the following month.