As it heads towards setting its budget – and of course Council Tax for 2024/25 – Peterborough City Council has reminded residents that it remains around £460m in debt. “This council’s overall debt remains relatively high at £462m in comparison to other local authorities, with Oflog (Office for Local Government) noting debt servicing costs are over double comparator authorities,” says a report to a council committee on January 22.

The report ‘red flags’ the fact that Peterborough has around £79m of debt maturing in the next year “which may require refinancing at higher rates.

And refinancing this 17 per cent of overall debt “presents a risk with higher interest rates.

“The council’s reserves balances are low in comparison to other local authorities; this has been highlighted by DLUHC and in the new Oflog published data.

“The latest forecast for reserves balances also shows them reducing by 41 per cent from £70m to £41m.

“Meaning the council’s overall financial resilience is weakened, and the scope to replenish and build reserves balances is limited.

“Although the council has been able to balance its budget without needing to directly use reserves, the overall financial risk has increased, and financial resilience appears to have been weakened at this stage.”

The report offers a ‘state of the nation’ report on the council’s finances, sets out where savings could be made and where extra costs are inevitable because of inflation and rising demands for its core services.

It says: “Local government finances have been eroded with funding levels failing to keep pace with the rising demand for services.

“Additionally, there is significant uncertainty around future funding levels. The local government settlement left the council with less grant than expected.

“With a number of pending reforms such as fairer funding and adult social care, the end of a spending review and a pending general election, the uncertainty will continue for the foreseeable future.

“The pandemic and economic climate has affected household finances and the cost of running council services.

“It has also resulted in increased levels of national debt, meaning austerity is likely to continue.”

The committee will be told in no uncertain terms that its chief financial officer “is of the opinion that the reserves balances estimated as at 1 April 2024 are adequate for the year ahead, but beyond 2024/25, without additional funding or further significant transformation, there is a risk that reserves balances may not be sufficient to bridge any budget gaps or unexpected events or emergencies”.

The report is unequivocal in what those pressures are and begins by pointing out the assumption that Council Tax will increase by 4.99 per cent (which includes a 2 per cent ring fenced adult social precept).

It means the Band D rate will increase to £1,666.27 in 2024/25, £1,749.42 in 2025/26 and £1,836.72 in 2026/27.

The city council is currently restricted to a 3 per cent increase on core Council Tax, before the requirement for a city-wide referendum.

“Any authority proposing an increase in Council Tax above the referendum limit must hold a local referendum and obtain a ‘yes’ vote before implementing the increase,” says the report.

“If a referendum is held after the beginning of the relevant financial year, the higher rate of Council Tax will be payable unless and until it is overturned by a ‘no’ vote in the referendum.

“Should referendum limits be increased by Government this could help to meet the reported budget gap.”

Officers say that the Government’s funding to the city council contains an “an explicit admission” that it expects councils to increase Council Tax to the referendum limit.

The good news is that inflation is now at 3.9 per cent and forecast to reduce further during the remainder of the year and into 2024/25.

“Inflation assumptions have been reviewed as part of the budget setting process and incorporated within estimates,” says the report.

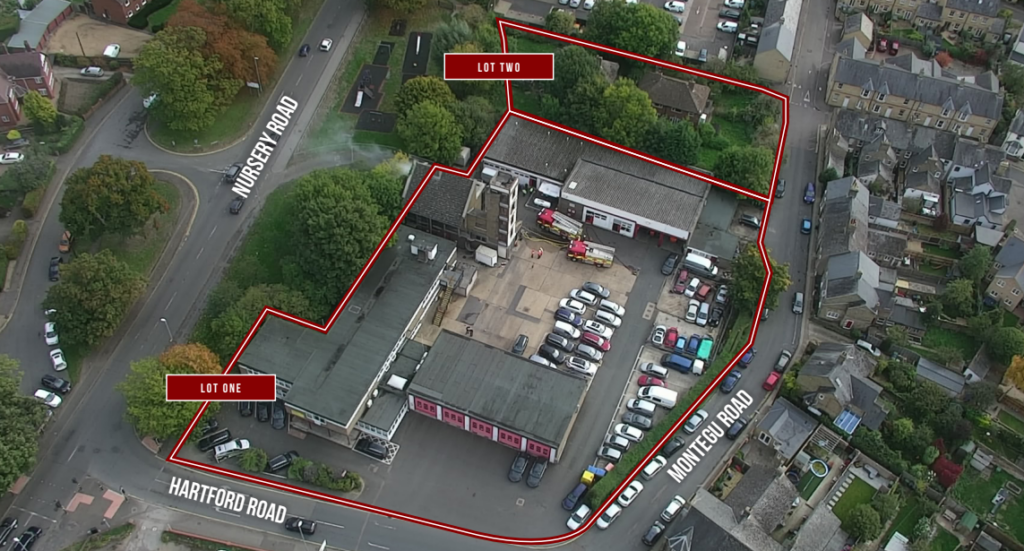

The council says its aim is to only borrow where appropriate “and therefore to rely on capital receipts to fund part of the capital programme”.

It has previously drawn up an asset disposal plan that “identifies a pipeline of potential capital receipts.

“There is, however, a risk that these receipts aren’t delivered in a timely manner, due to the reliance on the external parties.

“During 2023/24, we have experienced delays mainly due to market changes and unforeseen circumstances, including purchasers reneging on agreed transactions.

“However, the anticipated capital receipt forecast for 2024/25 is currently significantly higher than the 2023/24 financial year and has been risk rated and profiled considering the likelihood and probability of the receipts”.

On a brighter note, the officer’s report says the council has maintained a strong record of financial management; a final overspend position has only being reported once in the past 10 years.

“Where an overspend has been forecasted during the year, the whole organisation has risen to the challenge and driven down expenditure to deliver a balanced position,” says the report.

“This has become more challenging over the years, and as noted within the report, the current year forecast is projecting an overspend of £3m, and the proposed 2024/25 budget contains a higher degree of risk than previous years.

“This makes it more difficult to mitigate delays in savings or manage unforeseen expenditure within the overall budget envelope.”

So, what can we expect in 2024/25? Here’ s a snapshot of what the report says and what the committee – actually a joint meeting of scrutiny committees – will discuss.

1: The council has agreed to end the contract with Serco in April, with around 275 staff working in business support, customer services and shared transactional services such as revenue and benefits.

Councillor John Howard, deputy leader and Cabinet member for corporate governance and Finance, said: “I would like to thank Serco for the services they have provided for the council and residents in the past 13 years.

“The main driver for this is not about reducing headcount, but to ensure all aspects of our services can be incorporated in our transformation journey which is a key part of our council achieving financial sustainability.”

2: The city council proposes to sell the Wellington Street and Dickens Street car parks to help regenerate this area.

The report says there will be a loss of income following their sale “but we will actively work to direct current car park users to other council-owned car parks and to develop new parking provision nearby”

3: The council proposes to increase charges for parking in its car parks and other council-owned assets, specifically:

- Introduction of a surcharge (£20 pa) for additional and visitors permits.

- Increase in the first residential permit charges from £44pa to £50pa for first permits, and £70pa for others.

- Removal of the off-street evening rate, and introduction of flat rate charging 7am-8pm.

- Extension of on-street charging to 8pm (from 6.30pm) to align with off-street charges.

- Changes to daytime off-street rates (including removing some charging options).

- Changes to daytime on-street rates (including removing maximum stay periods).

- Introduction of new charges for bay suspensions (e.g., utilities works, development etc).

- Introduction of a fee for parking dispensations (e.g., access to pedestrianised areas/parking on double yellow lines for works).

4: The council currently funds a school crossing patrol service at five schools. The council is proposing to carry out a review specific to each location, looking at changes if the relevant data shows that some form of safety intervention is still required.

“These changes could include engineering solutions, partnering with the relevant schools, and local volunteering schemes,” says the report.

“These will only be introduced where circumstances allow as maintaining the safety of schoolchildren remains our utmost priority.”

5: The council wants to limit access to the Household Recycling Centre (HRC) to Peterborough residents only.

“This will ensure that Peterborough residents are prioritised for HRC access, as well as reducing the council’s waste treatment costs,” says the report.

6: Gladstone Park Community Centre is the only community centre that is managed and run by council staff.

The proposal is to transfer the centre to a third party “via some form of asset transfer, removing the staffing and associated costs currently incurred by the council.

“We will work closely with local ward councillors and relevant community groups to ensure the most appropriate outcome for the centre and the communities it serves is achieved”.

7: The council says it wants to expand the new city market “which will enable a more diverse market offer”.

8: The report says that in 2023 the council asked the public whether the Cathedral Square fountains should be repaired and switched on or not.

“Most respondents wanted the council to spend money on other priorities and as a result, this proposal looks to keep the fountains switched off permanently,” says the report.

“We will develop a plan aimed at making the best use of Cathedral Square including community events, pop-up markets, and festivals.”

9: Higher fines can be expected for those caught fly-tipping and littering. The council says it follows changes in national guidance which allows fines to rise.

“We will adopt this new guidance, further enforcing our work to tackle fly-tipping and littering in our communities,” says the report.

10: Adult day care services are to be reviewed, redesigned, and “potentially” relocated.

11: Disability related expenses (DRE) are extra costs that a person may have to pay because of their disability or care need. Currently the city council provides three DRE payments of £10, £15, and £20 which are allocated to clients based upon the level of disability benefit received by that individual.

Peterborough is one of a few local authorities that allocates DRE payments in this way.

“We are proposing to undertake a public consultation to remove these automated payments and set up a means tested system, as adopted by most other local authorities,” says the report.

12: Children’s services recruitment issues, particularly social workers will include “exploring international recruitment, and the development of a social care academy to provide a new social work offer to newly qualified social workers.

“The academy would provide wrap-around support for newly qualified social workers, giving them real life experience and the chance to learn from their peers, whilst keeping caseloads manageable

“Once established this should reduce the council’s need for agency social workers”.

13: The House Project proposes establishing a council-lead local housing project run for young people (16-18) who are leaving care. It is designed to ensure young people leaving care experience this together.

Young people will work on houses which become their homes to live in.

14: Separation of services which have previously been run jointly with Cambridgeshire County Council “where it is in our best interests to do so, including the fostering service.

“We will look to increase the numbers of council fostering placements, enabling us to reduce the numbers of children placed in more expensive agency placements”.

FOOTNOTE

This report to the Joint Meeting of Scrutiny Committees IS part of the Council’s formal budget setting process. Any recommendations made by the Joint Meeting of the Scrutiny Committees will be reported to Cabinet on 12 February for consideration.