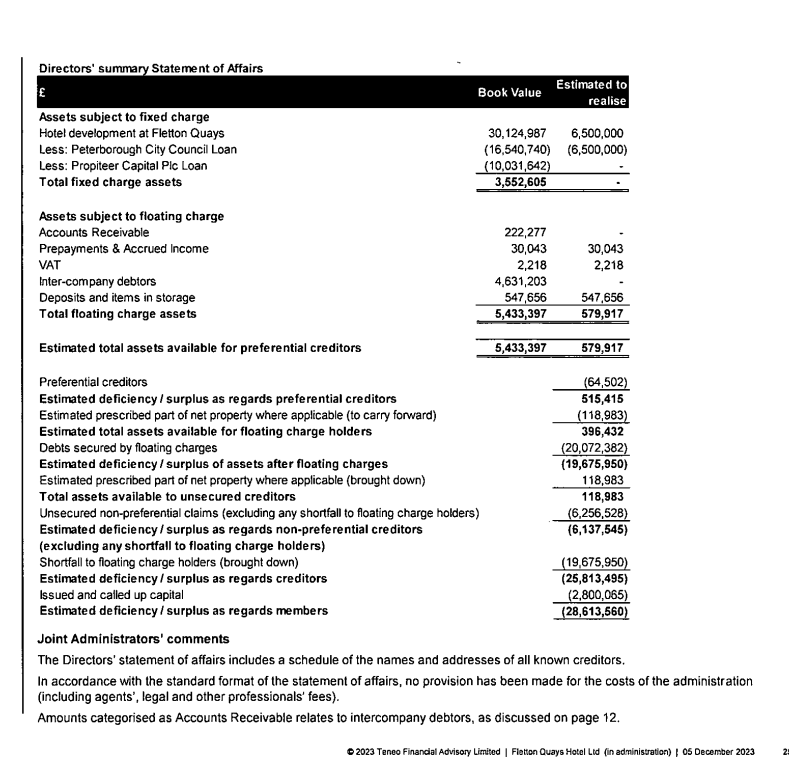

Peterborough City Council proposes a credit bid – effectively swapping the £17m it has loaned to developers to build the Hilton Hotel at Fletton Quays to buy the freehold. It will need at least £14.4m more to complete it.

And with other costs such as stamp duty, legal fees and administrators, the final bill is expected to come in at £32.5m.

£10m has already been set aside in the 2024/25 budget but a report to Cabinet on March 11 suggests the Government may be asked for help.

“If no grants are available and more funding were required from the council, then the £10m contained within minor capital programmes could be utilised,” says the report.

“Also, the costs-to-complete from the consultants are being challenged as there are certain costs and assumptions that could be reduced or removed.

“This includes where it is proposed to pay 64 previous suppliers in full so warranties can be received.

“A full review of the costs-to-complete will be concluded in March and will inform the final business case to support any acquisition.”

Cabinet will hear that the current ‘as is’ valuation (indicated at circa £1.45m) assuming the site is sold today and accounts for the estimated costs-to-complete of £14.4m.

The valuation also accounts for construction risks, borrowing costs and profit for any purchaser/developer taking on the project.

The brightest scenario painted by the report is that Peterborough City Council – like a handful of other councils across the country – will end up owning a major hotel.

The downside is that “harder trading times for hotels” are forecast by the council’s own consultants which suggest that even after 3 years of trading, again according to the council’s own consultants when the “optimal value of a hotel is reached”, the Peterborough Hilton would still only be worth £22m.

And that, Cabinet will be told, could mean a loss to be written off by the council, if they do sell it then, of £10.5m.

More gloomy outcomes are forewarned by Cecilie Booth, the executive director for corporate services who has compiled the report.

“An additional factor that may impact stakeholder involvement is that on 17th February 2024, administrators were also appointed to Propiteer Fletton Quays Limited, the company which owns the apartments adjoined to the hotel,” she says.

“The hotel administrators are in discussions with the administrators for the

apartments to understand their proposed strategy so they can consider any implications for Fletton Quays Hotel (the developers now in administration).

“Although the council has no financial exposure to the apartment development, we will keep a close eye on progress and an update will be provided in the next Cabinet report.”

Ms Booth is inviting Cabinet to support the option for a credit bid and for a business case to be brought forward.

She will remind Cabinet that the city council provided a loan to Fletton Quays Hotel Ltd to build a Hilton Garden Inn hotel. The loan agreement was extended three times, the last time in May 2023.

“Due to lack of progress since then, the council exercised its powers in the loan agreement to place the hotel developer into administration in November 2023,” she says.

“The council has repeatedly said it is committed to ensuring the hotel is completed and the council’s investment is protected.”

Prior to putting the company into administration, council consultants had predicted the hotel would be worth £25m once completed and, after deduction of costs, would have seen an overall loss to the council of £3m after 5 years of trading.

“The position is now more nuanced as, following the work by the property consultants, the costs to complete have increased,” says the report.

“In addition, the expected value of the completed hotel has reduced, this is primarily due to an increase in the investment yield and is a result of harder trading times for hotels.”

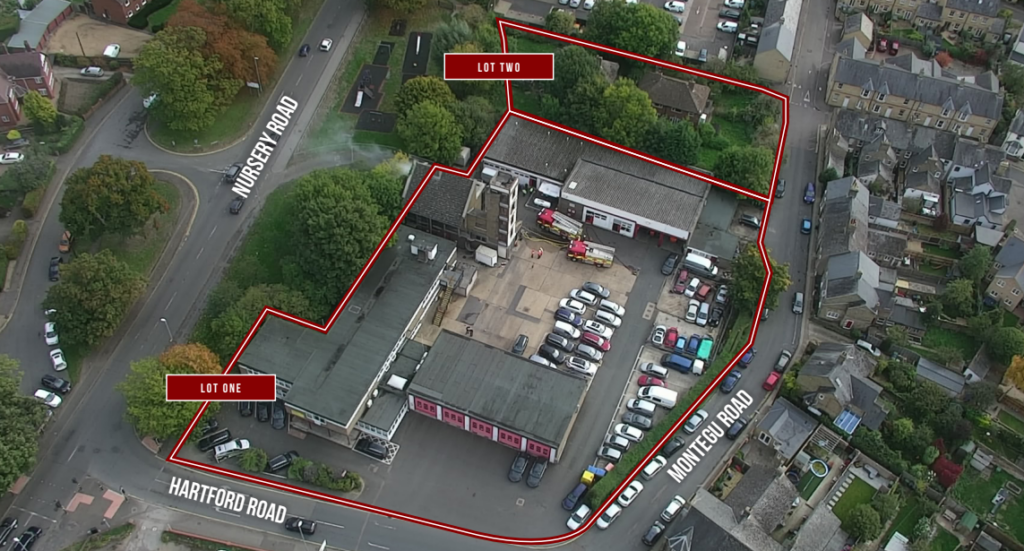

With the hotel in the hands of Teneo, the administrators, the report says it was marketed as a ‘closed’ procurement exercise, limited to companies with a legal interest in the hotel, on 13 February 2024.

“The council have been advised that a full marketing exercise would take at least a year, and it would be expensive to prepare the full marketing documentation,” says the report.

“Doing so would mean that the hotel would remain undeveloped for a much longer period.”

The property is not heated and there are fears it would deteriorate if left for another winter.

In addition, delays would incur additional security costs and interest payments being incurred.

The marketing exercise closes on 4 March.

And that, says the report, is why approval is needed to submit a credit bid of up to the value of the outstanding balance of £17m.

“The council does not have to meet the bid deadline and can bid later with the benefit of seeing the other bid before making its own,” says the report.

“This means the council may choose to accept an alternative bid if it is within a suitable tolerance range. “

Ms Booth says the council’s proposals for the hotel are:

1: To continue to protect the initial investment in the hotel.

2: To ensure the hotel is built and completed to a high specification to support the Fletton Quays regeneration objectives. She says it is important to the council that this remains a flagship development site; the Hilton Garden Inn is a top end hotel and of a higher quality than Peterborough would normally attract.

“The recommendation is to submit a credit bid for the hotel,” she says. “This means that the council will submit a bid up to the value of the amount it is owed for the loan, i.e. £17m.

“It is not assumed that another company would submit a bid that high.

“The size of the council bid is aimed to ensure the council can continue to protect its investment and ensure the hotel is developed to the original high quality, including the sky bar.

“The council would then develop the hotel to completion with a suitable development partner and a range of advisors and with an operating partner in place to run the hotel as a Hilton franchisee post completion.

“This is believed to be the quickest way to complete the hotel and is the established delivery route for this type of development.”

Ms Booth believes the council can find an operating partner for at least 3-5 years to ensure the council gets its investment back.

Of course, she says, the council continue to own the hotel – something to be explored in the business case for a later Cabinet.

She said the Hilton remains committed to the Peterborough hotel and officers had “met with the “Hilton brand on several occasions and the Hilton are helping the council to develop the hotel to completion.

“The Hilton brand works as a franchise; the Hilton do not own hotels but work with approved developers and operators to run hotels for them.

“They are supportive of the council’s approach and are helping us to plan the next stages.”

Ms Booth said the council has spoken to four other councils who also own a Hilton Hotel.

“The feedback is that hotel occupancy rates are good and has exceeded expectations,” she says.

“The food and beverage element of sales are behind predictions, but overall, all are happy with their hotels, their operation and the trajectory they are on.”

Ms Booth says if the council declined to submit a credit bid it could be sold for considerably less.

“The hotel as it stands today will be valued as a ‘distressed asset’, and any third-party bid is likely to be significantly lower than the council’s current debt,” she says.

“It is therefore expected that a credible proposal will not be made.

“It is also questionable whether the hotel could be completed to the high standard expected of this flagship regeneration site, during earlier discussions with the parties involved, there was talk of a lower standard hotel or an asylum seekers hotel.

“If and when bids are received from the other interested parties, these can be considered.

“It is recommended that the council submit a credit-bid to secure the asset, develop the hotel to completion and develop a strategy to work with Hilton approved companies to ensure completion in the most efficient and effective way.”

Councillor Mohammed Farooq, Leader of Peterborough City Council, said: “It is regrettable that we are in this situation.

“However, we now either walk away and lose some or all of the money we have advanced, or we see the development through to completion and benefit from the return of our loan and a fantastic new hotel facility for Peterborough.

“The advice that we are receiving is that the best way to achieve this is by taking control of the freehold. We are not the only council to have taken this route and others have been successful in doing so.

“Our focus remains on seeing the hotel completed as soon as possible, providing a fantastic high-quality hotel and at the same time protecting the council’s investment. “Having a Hilton hotel in the city would be a huge asset and therefore I am pleased that Hilton remains committed to the development and to Peterborough.

“They are supportive of the council’s approach and are helping us to plan the next stages.

“I remain focussed on delivering best value with taxpayers’ money.”