Fenland Future Ltd – a development company set up by Fenland District Council and equipped with a £25m war chest – has admitted snail’s pace growth with 70 out of 72 commercial projects put forward all ruled out. An investment board overseeing it and chaired by council leader Chris Boden is yet to even meet in 2024.

Promised quarterly meetings appear to have been scrapped and the last meeting of the board was in November of last year – and even a scheduled meeting for next month has been cancelled.

Other meetings planned for January, March and June of this year were also cancelled.

Two schemes are under way, Cllr Boden, reported to his Cabinet colleagues in July and that is for the contentious 80 homes on land close to historic Wenny Meadow, Chatteris.

And Fenland Future Ltd is pressing on with a care home on the Nene Waterfront site at Wisbech.

“Outline planning permission has now been granted for both sites unfortunately commercial confidentiality means that we can’t go into too much detail in either case,” Cllr Boden said.

“We will also be starting the full planning application process for at least phase one of the Nene waterfront sites in the very near future as well.”

He said: “The one commercial investment that we made in in Wisbech continues to produce the revenue we anticipated so that’s working perfectly well and of course the revenue will increase as rent reviews come up.”

Cllr Tierney, along with Cllr Boden and Cllr Ian Benney the three councillors on the investment board, said: “Some people who watch our investment may seem like things are slow and methodical. I think that’s an asset.

“We have seen other councils try and do similar things and get themselves into hot water and I think the decisions that are being taken here are sensible are at the correct pace and the correct level of risk.

“And that’s what I actually want to see because that’s the way that we should always deal with public money and public investment which in the end is what this ultimately is.”

Cllr Boden said: “Some councils as we know around the country have significantly overstretched themselves and have ended up in a terrible financial position.

“As a result, one or two have actually made great success of it but more than one or two have not.

“Obviously, most of what I was talking about most of what FFL is doing at the moment is to do with development of our own land which is a slightly different matter but where it comes to outside commercial Investments we have been very prudent

“I’m sorry that we didn’t start the process earlier and it wasn’t agreed that we should start the process before I became the leader.

“But in that time, I think the last time I looked last time I checked 72 proposal suggestions had been given to me and I ended up having to – in conjunction with officers – reject 70 of them because I didn’t feel confident enough that they were secure enough for us to use public money on.

“And of the two which we agreed should move forward one of them didn’t move forward because body which was selling the particular development possibility changed their mind, so we have only ended up with one item.

“In terms of pure outside commercial investment that we’ve undertaken and that has worked well but it’s much better in this case to be on the side of caution and that is what we’ve done.

“The danger is that if we had not been so cautious we may be having a very different discussion even now let alone what may be the case in a few years’ time if something goes wrong.”

Senior officers of the council told Cabinet a formal review of the commercial and investment strategy is underway “although the present economic conditions are challenging and interest rates in particular makes it extremely difficult to identify new opportunities.”

In a yearly progress report, officers noted that the investment board was created on 16th January 2020 “to help drive forward the council’s commercial and investment strategy which was approved by full council on 9th January 2020.

“The investment board is a sub-committee of cabinet designed to be more ‘fleet of foot’ in order to be able to respond to opportunities in an agile and commercial manner.”

Fenland Future Ltd is regarded as a Local Authority Trading Company (LATCo) and is able to able to utilise reserves and/or borrow sums up to a combined maximum of £25 million “in order to deliver the objectives of the council’s strategy”.

At the end of March 2022 £4m of this facility has been utilised to fund the acquisition a commercial investment in Wisbech which officers say has delivered a rental income of £230k per annum since acquisition in March 2021 and is up to date for 2023-24

“As we used our own funds to acquire this asset there was no external cost of capital,” says the annual report.

A separate board of directors – comprising council officers – has Dan Horn as managing director, Mark Saunders as chairman, and Anna Goodall as a director. Jane Bailey is company secretary.

On The Elms site in Chatteris, Lovell Homes have been commissioned to work with FFL as a development management partner.

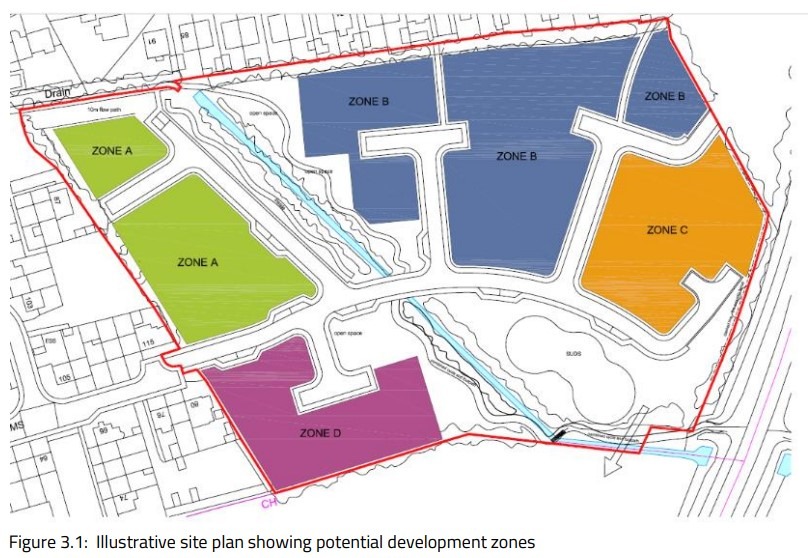

At the Nene Waterfront in Wisbech, a reserved matters application is being prepared for 1 of the 5 plots for a circa 70 home affordable housing extra care scheme.

“No further opportunities have been formally presented to the investment board since 1st April 2022 as the initial due diligence as prescribed in the commercial and investment strategy was not passed”, said the annual report.

You can read in more detail objectives of Fenland Future Ltd in this report from 2022:

https://www.fenland.gov.uk/localgov/documents/s10035/Report%20and%20Business%20Plan%20-%20public.pdf