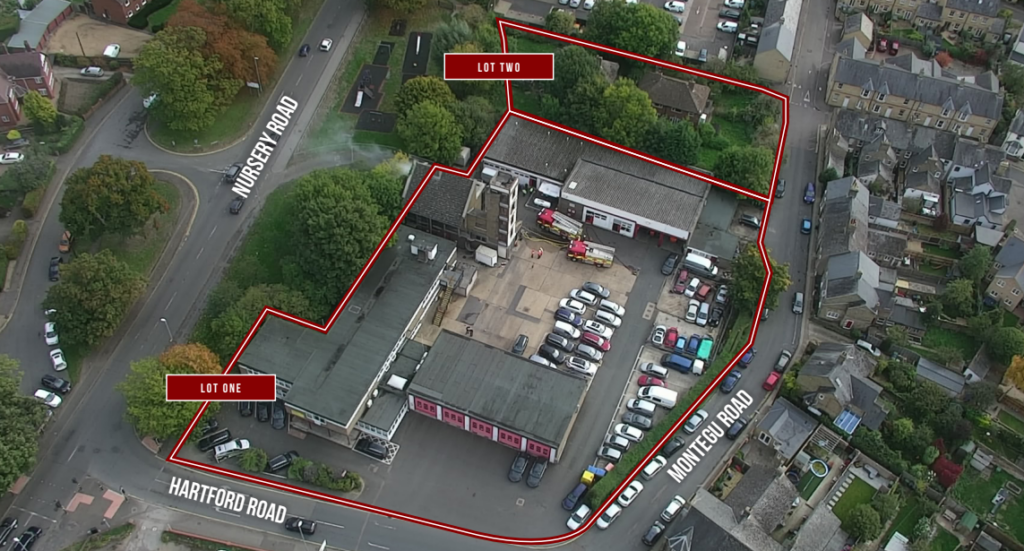

Cash flow from sales of an ambitious multi-million-pound project to refurbish 92 former MoD houses in Ely remain behind forecast, says a new report.

It could mean East Cambs Trading Company Ltd (ECTC) -the commercial arm of East Cambridgeshire District Council – having to find alternative financing when a loan to complete the works expires next March.

A loan of £24.4m was made to ECTC by the Cambridgeshire and Peterborough Combined Authority (CAPCA) to refurbish the homes at Kilkenny Avenue (now known as Arbour Square).

The deal – agreed by then Mayor James Palmer – is for the provision of 15 affordable units within the overall scheme.

CAPCA housing committee will hear that 62 of the units are sold.

As of October 31, the balance of the loan was £8.774m.

Housing director Roger Thompson says: “At the time of the last report it was £10.965m.

“Since the last update, the balance of this loan has been reduced significantly due to continued unit sales and repayments, with total net repayments of £2.191m over the period.”

But he notes that “the most recent monitoring report advises that the cash flow from sales is still behind what was previously forecast.

“Repayment of the loan by end March 2023 will depend on how quickly the properties can be sold.”

Mr Thompson says ECTC officers had advised CAPCA “that they have access to a facility in the event of any shortfall in sales to repay the loan by end March 2023.

“Officers will continue to monitor the situation and provide update reports to housing committee.”

ECTC has until 31 March 2023 to repay the loan and no direct intervention can be taken by the Combined Authority unless default occurs on 31 March 2023.

Mr Thompson’s report will go to the housing committee on November 14.

In March, CAPCA was told that £410,000 had been removed from the construction project to reflect homes that are “now to be ‘sold as seen’ to accelerate cashflow”.

Mr Thompson said at the time that additional options available to ECTC to avoid default include re-financing, portfolio transfer, accelerating the volume of sale with a block investment sale or utilising company reserves to clear the balance of the loan when it determines.

Mr Thompson said that ECTC had until March 31, 2023, to repay to repay the loan and no direct intervention can be taken by the Combined Authority unless default occurs on that date.

Cllr Lucy Nethsingha said there “lots of elements of concerns over these loans and have been for some time”.

Mr Thompson said cash flow was being followed closely and in recent weeks sales were picking up of the former MoD homes and CAPCA was seeing “steady progress”.

“They do have significant number of sales under offer and are trying to push remaining market units not under offer,” he said.

His ‘affordable housing programme loans update’ report explains how the cash loaned out by CAPCA has, or is, being repaid.

Mr Thompson explains that as part of the Devolution Deal, the Combined Authority secured funding from Government to deliver an affordable housing programme that ended in March 2021.

The Combined Authority’s housing strategy approved by board in September 2018 divided the funding into two parts.

£60m was allocated for traditional grant funding and £40m was to be used for the then mayor’s plan for a revolving fund to support the delivery of additional affordable housing.

The revolving fund initiative committed a total of £51.167m through 5 loans to development companies to fund delivery of 53 affordable units.

In August 2020, the Combined Authority’s board approved loan extensions and interest free periods to reflect the detrimental impact upon delivery of projects caused by the Covid pandemic.

“In March 2021 Government conditionally agreed to a new affordable housing programme for 2021-2022 on the basis that all loan repayments were allocated to support the delivery of additional affordable housing through grant funding,” says Mr Thompson.

The table below shows the headline detail of each loan:

The financial balance sheet showing an outstanding balance of the loans can be found at Appendix 1.

Mr Thompson says project monitoring for West End Gardens, Haddenham forecasts repayment of the loan by ECTC before March 2023.

“All except one plot has been reserved at prices above originally anticipated values,” he says.

“The development is expected to have a positive financial outturn for the developer.

“Repayments continue to be received and full repayment with interest is expected around the end of January 2023.”

The loan with Laragh Homes on the project at Alexander House, Forehill, Ely was fully repaid with interest on 20 June 2022.

The loan with Laragh Homes on the project at Linton Rd, Great Abington was fully re-paid with interest on 13 December 2021.“The project at Histon Mews, Cambridge is progressing,” says Mr Thompson.

“The independent monitor suggests the project should complete around April 23.

“The agreed redemption date of the loan facility is 7 May 2023.

“We understand that units are being reserved ‘off plan’ ahead of a phased construction completion and this is a positive indicator for the success of future sales and the repayment of the loan.”

Mr Thompson says: “We are making enquires of the developer as to what their contingency plan is, in the event that insufficient sales have been completed to fully cover the re-payment of the loan and interest by 7th May 2023.

“We will continue to closely monitor progress over the next 6 months.”

Paul Remington, chair of East Cambs Trading Company Ltd, said in March of this year Palace Green Homes, its housebuilding operation, was responsible for the refurbishment of the 92 homes at the former RAF estate at Kilkenny Avenue, Ely.

He said: “Sixty-nine of the homes have now been refurbished “and families are once again living on the estate.

“The company is on track to complete the refurbishment project during 2022.”

He said the company “company remains confident that the remaining properties at Ely will be completed and the loans repaid in full before the final loan repayment date of March 31, 2023.”