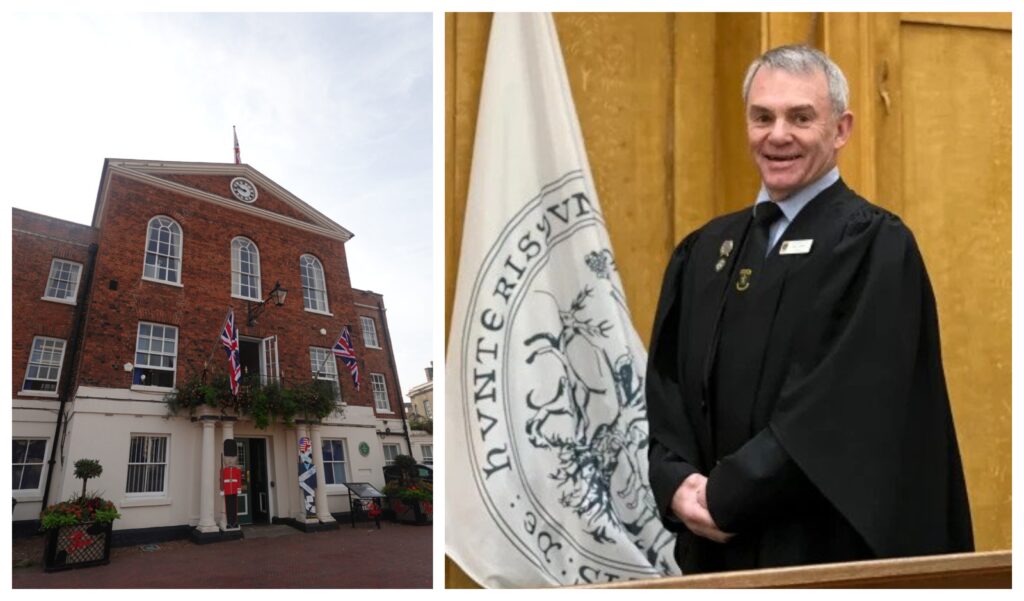

Finance committee chair Brian Luckham says Huntingdon Town Council had no option other than to raise Council Tax by 17.5 per cent for the coming year. Cllr Luckham, an independent town councillor since 1999, said: “Huntingdon Town Council has carefully reviewed its financial position and agreed to a 17.5% increase in the precept for the coming year.

“This decision was not taken lightly, but several factors have made it necessary to ensure we can continue delivering good services for the community.”

He said: “Unlike district and county councils, town councils receive no funding from central government.

“The entire precept is raised locally and collected by Huntingdonshire District Council on our behalf.

“Additionally, while larger councils are exempt from National Insurance contributions for their employees, town councils are not, adding to our financial pressures.

Cllr Luckham added that “it’s also important to note that unlike district or county councillors, Huntingdon Town Councillors dedicate their time without receiving salaries or expenses”.

On Thursday 16th January 2025, Huntingdon Town Council held a full meeting of the Town Council, where the financial budget for the 2025/26 year was agreed.

Members resolved to set the 2025/26 Precept at £2,117,046 equating to a 17.5% increase on the Town Council’s 2024/25 precept.

“Due to tax base fluctuations, the actual increase for households is 16.9%,” said a council spokesperson.

“This represents a weekly increase of £0.76 per week on a Band D property, or £0.59 per week on a band B property. For those that pay via direct debit in 10 monthly payments, this represents an increase of £3.96 per month for Band D properties and £3.08 per month for Band B properties. Most properties in Huntingdon are Band B.”

The precept equates to 61.34% of the Huntingdon Town Council’s annual income, with other income (36.87%) coming from the crematorium and cemeteries, rental income from council owned properties, and grass cutting and verge maintenance on behalf of other local authorities.

The final portion of budgeted income (1.97%) will be from existing reserves and investments.

The council rejected a recommendation from its finance committee that the rise should be 20 per cent.

The rise comes on top of a 9.2 per cent increase agreed for 2023/24 and a 14 per cent increase the previous year.

Labour councillor David Landon Cole, who represents Huntingdon North East ward, said: “I voted against the budget and the precept.

“I appreciate that people will be disappointed or even angry with the result,” he said. “While I disagree with people who voted for the budget and the precept, I do understand the reasons why they voted for it.

“I would ask that people remain temperate in their comments.”

District councillor Nathan Hunt (Lib Dem), who is not a town councillor, addressed the budget setting meeting.

“I spoke against the town council’s proposed 20 per cent Council Tax rise and urged them to delay confirming their budget due to severe concerns around the budget documents presented,” he said.

“At this evening’s meeting a reduced rise of 17.5 per cent was approved by a majority of councillors, and as such a significant precept rise will be going ahead.

“A 17.5 per cent increase in the town council’s part of the Council Tax bill equates to about £39 per year (to a new total of around £275) for a Band D property, and slightly less for Band C, B, or A properties.”

He added that “whilst I’m a district councillor and therefore don’t have a say or a vote on the town council’s budget, I always work closely and pay attention to town council matters due to their impact on residents in my ward – hence my concern about this significant rise”.

Cllr Tom Sanderson, an independent councillor for Stukeley Meadows, said that there was an attempt “to block certain elected members from voting on the budget and precept, then we were accused of being thieves!

“The 20 per cent precept increase was not approved though; 17.5% precept increase agreed, again I voted against”.

He said it had been suggested that “those of us who also sit on the district council have a conflict. Not been a problem before in my 25 years in both councils”.

Social media reports of the meeting point to Cllr Phil Pearce, who also represents Stukeley Meadows, for arguing that district councillors who are also town councillors should not be able to vote on the budget and precept because of a conflict of interest.

Huntingdonshire District Council, as the principal authority had requested that the precept request was submitted by 17th January 2025, to enable them to sign off all precept demands in mid-February; however, the legal standing is that Huntingdon Town Council does not have to submit its demand for precept until 1st March.

While some councillors are attached to parties, most are independents.