East Cambridgeshire District Council says it will take £2.5m out of its “surplus savings reserve” to ensure it can, for the 10th year running, freeze its council tax.

Council leader Anna Bailey says East Cambs “is the only district or upper tier (county) council to have done so in the country”.

She added: “We do it not because we are ideologically opposed to increasing council tax, but because we planned it and we have achieved it.

“We have also improved our income through the 100% council owned East Cambs Trading Company.

“East Cambs Trading Company has built new homes reserved for local people with ties to their community, the Ely markets programme and parks and open spaces.

“This has contributed £3.6m to date to the council.

“By doing all of this, we have been able to freeze the East Cambs element of council tax for 10 years.”

Cllr Bailey added: “To put that into context, a 1% increase in council tax at East Cambs would only raise about £45k.”

It means council tax payers in East Cambs will continue to pay £142.14 for a Band D property.

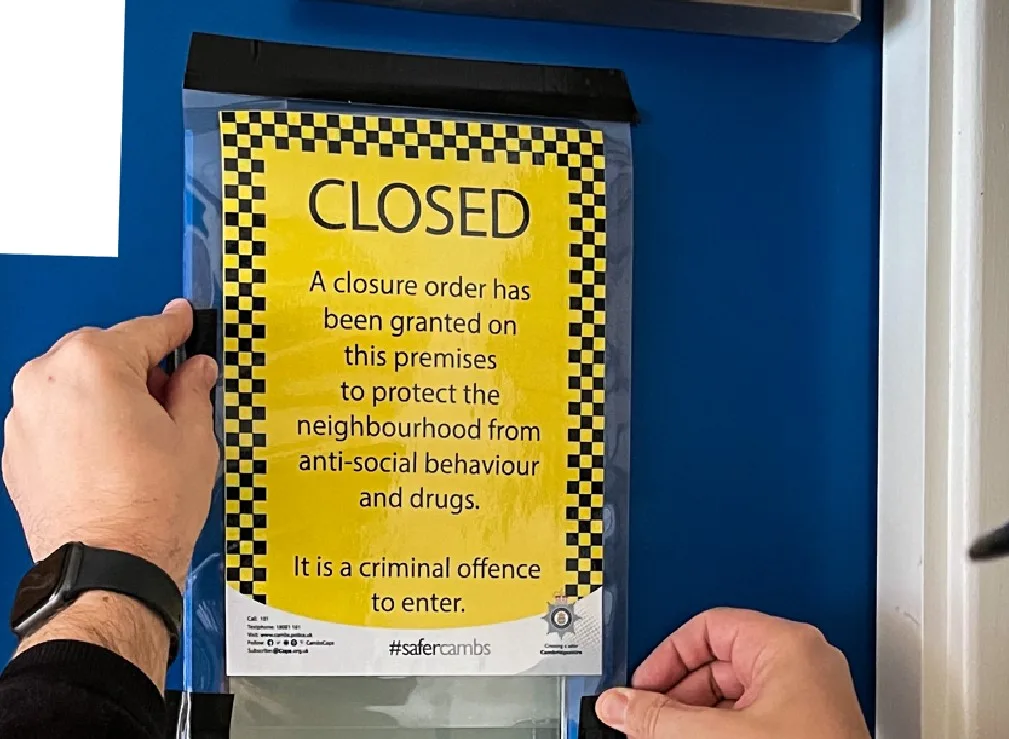

The council is raising additional income by increasing the council tax premiums it charges for long-term empty properties.

The revised premiums are 100% on properties empty for over two years, bring the total council tax bill to 200%.

In addition, there will be a further 100% increase on properties empty for over five years, bringing the premium to 200% and the total council tax bill to 300%.

And then further, a further 100% increase after ten years, bringing the premium to 300% and the total council tax bill to 400%.

Cllr Bailey says East Cambs “remains committed” to only raising council tax “if needed”.

She said: “This budget does propose that we recommend to full council that we do freeze council tax again for the forthcoming financial year.

“I recognise it is a relatively modest contribution in the great scheme of council tax bills which are increasingly expensive for residents. £142.14 for a Band D property in 2013 and remaining at £142.14 for a Band D property in 2023 and I think this council can be proud that it offers excellent value for money from that income.”

She says the surplus savings reserve is “a kitty that underspends go into” and helps to ensure the council is not in the position of having to make cuts.

“We have £0 external borrowing,” she added.

Finance director Ian Smith set out the council’s proposals in a paper approved by the finance and assets committee that will go to full council in February for ratification.

He said his report “assesses the robustness of the budgets, the adequacy of reserves and up-dates the council’s medium term financial strategy (MTFS)”.

Mr Smith explained that “due to the actions taken by management to reduce the council’s cost base prior to and during 2021/22 and the prudent forecast of Business Rates receipts, the council underspent in 2021/22 by £2,367,039.

“This was transferred into the Surplus Savings Reserve”

“Management has continued to look for opportunities to reduce the council’s cost base during the current financial year.

“This work has led to further one-off and ongoing savings being made, which both contribute to the projected outturn for this financial year and also provide savings throughout the term of the MTFS.

“Although in year, these have been matched by inflationary increases far in excess of those expected when the budget was built.

“The current yearend forecast underspend for 2022/23 is £191,100, this too will be transferred to the Surplus Savings Reserve at yearend and has been reflected in the figures in this report.”

Mr Smith said key assumptions in the draft budget included:

1: The April 2023 inflationary pay increase for staff has been assumed at 4%; Inflation has been put in at 80% for gas and electricity;

2: Where known, inflation on contracts has been included to reflect the expected increase in these during the year. These include insurance and IT licences.

3: 21% has been added to the Waste contract with East Cambs Street Scene (ECSS) and 6% for the Parks and Gardens contract with ECTC.

4: Other expenditure budgets have been increased by 6% for inflation.

5: No adjustments to spend have been made to reflect the anticipated increase in population within the district.

6: Budgeted income from the commuter car park and the leisure centre management fee both remain reduced when compared to the value in the 2020/21 budget to reflect the on-going implications of the Covid-19 pandemic on these services.

He added: “The council holds reserves, at levels which remain prudent.

“It is important to review the level of reserves on a regular basis, in particular to ensure that potential liabilities not in the council’s base budget can be funded from earmarked reserves.

“And that unearmarked reserves are at a sufficient level to cover any unforeseen events.”

Mr Smith says keys risks around the budget remain Government funding of the council and inflation.

“The Provisional Settlement provides clarity around grant funding for 2023/24 and to a lesser degree for 2024/25, but looking beyond that, there is very limited information to put forward a MTFS based on confident assumptions on future Government funding,” he said.

“Possibly the greatest concern for this council however, is the Government’s intention to implement a full Business Rate baseline reset at the time of the Fair Funding Review.

“The current baseline was set in 2013, when all councils were given a share of Business Rates equal to their calculated needs.

“Since then councils have been allowed to keep a share of their growth, which for us as a district council has been 40%.

“In broad figures our baseline is £2.56 million, where we actually budget for £4.5 million of Business Rates because of this growth.

“If the baseline is fully reset, we will lose this growth and won’t know what our revised baseline will be until the results of the Local Government Fair Funding Review are announced.”

Mr Smith says an allowance has been made in the MTFS for this probable reduction, but at this point, there is no certainty on what this is likely to be.

He said: “Unlike the position for a number of years, inflation is playing a major part in the economy at the moment, and so needs to be considered with much greater focus this year.”

Offering context he says the council has budgeted for a 4% increase in staff costs from the 1st April 2023, if pay was to increase by 5% this would cost the council a further £91,326.

He also warned councillors: “The MTFS assumes the remainder of the Surplus Savings Reserve is utilised during 2024/25 and 2025/26, which will reduce the overall level of reserves significantly.

“Reserves can only be utilised once and while the purpose of the Surplus Savings Reserve is to provide one-off funding to balance the budget in future years, the council needs to be considering all options to reduce the speed that this is being utilised so that it remains available further into the future.”

Another key risk for the council, says Mr Smith, is the loan to ECTC.

“Should ECTC encounter any financial difficulties and be unable to repay the £7,500,000 loan facility, then the council will need to account for this within its financial statements,” he says.

“In such an event, the council would need to draw on its reserves to meet such a liability.

“At this point however, it should be noted there is no indication that this is likely to be the case and indeed not all of the loan facility has, as yet, been drawdown.

“To limit this risk further, the council has security in place with regard to this loan in the form of a debenture which will provide it with first ranking security over all unsecured assets of the company, once the loan to the Cambridgeshire and Peterborough Combined Authority is repaid, which is expected to be in 2022/23.

“A potential further risk for the council is the possible need to up-date the Local Plan in the next four years. No costs are built into this budget to reflect the costs of this at this point.”

Mr Smith says: “The council has a track record of delivering cost reductions.

“It is anticipated therefore that a contribution to the budget deficit forecast in future years will be achieved during the term through general efficiencies and income generating opportunities.

“However, to be prudent, no account of these are shown within the forecasts within this report.”

But in conclusion he says his report “shows the budget for 2023/24 and 2024/25 is fully funded.

“However, there are significant budget shortfalls projected in 2025/26 and subsequent years.

“Clearly many things will change between now and then, so members should not focus on the precise numbers.

“What is far more important is that members appreciate the direction of funding facing this and many local authorities, and the likely scale.”

He said: “It will be necessary to develop a plan to meet these shortfalls, although the council does have time (although limited) to put the necessary plans in place.”