Fenland District Council’s ‘political’ decision to reduce Council Tax by 2 per cent comes with a health warning from its finance director and chief accountant.

In a report to Monday’s budget setting full council chief finance officer/corporate director Peter Catchpole and chief accountant Mark Saunders set out the risks.

“The implications of not increasing Council Tax over the remainder of the Medium-Term Financial Strategy (MTFS) is that the council will be reducing its financial base permanently as it would not be able to recover potential revenue foregone due to the cumulative year on year impact,” they warn.

“The consequences of continually setting zero Council Tax levels and not achieving the necessary savings/additional income have been clearly demonstrated by the events at other councils.

“The ability to achieve significant year on year savings (without increasing existing and/or introducing new revenue streams together with transformational change) to balance the budget becomes progressively difficult without eventually impacting on front-line services and delivery.”

Councillors will be invited to approve the budget which shows a 2% reduction in Council Tax for 2023/34 but extends the MTFS period showing 0% increases thereafter to 2027/28.

Both officers say The MTFS projects shortfall increases year on year, reaching £1.918m in 2027/28.

“Projected shortfalls in the MTFS are usual, both in FDC and in Local Government generally,” they say.

“They represent the challenge to be faced in future years in reaching a balanced budget position each year.

“Any decision this year to reduce the level of Council Tax necessarily increases the scale of that challenge.”

Their report says there are currently many uncertainties regarding the budget for 2023/24 and the MTFS.

“There remains a significant structural deficit which the council will need to address.”

The Band D Council Tax level for Fenland District Council Services for 2023/24 will be set at £255.24, a decrease of 2% (£5.22) on the current year.

Both officers concede: “There is still considerable uncertainty around the estimates for 2023/24 and the forecasts for the medium term.

“Currently there are a number of ‘unknowns’ which could both positively and negatively impact on the forecasts.”

Officers prepare list of ‘unknowns’

These include:

1: Impact of potential changes to the New Home Bonus methodology and allocations from April 2024

2: Impact of the business rates revaluation from April 2023 and longer-term changes to the Business Rates Retention system from April 2025

3: Impact of potential additional costs and income in 2024/25 from managing packaging waste

4: Impact on income streams being greater than anticipated due to external factors such as port income (sale of Port Sutton Bridge)

5: Continuing impact of homelessness temporary accommodation costs in 2023/24 and the medium term and the impact on recovery of housing benefit subsidy

6: Potential for additional support for the leisure management contactor Freedom Leisure in 2023/24, (over and above the provision provided in the estimates) and over the medium term, as a result of the energy costs crisis.

7: Impact of increases in fees and charges (where feasible) on the 2023/24 estimates and MTFS

8: Impact of service developments e.g. Civil Parking Enforcement (CPE)

9: Revenue impact of funding new capital schemes not currently included in the capital programme.

“There are currently a number of schemes which require consideration with potentially substantial funding needed over the medium term,” says the report.

The council has budgeted for £1m worth of works to repair the suspended quay at Wisbech Port but has been warned further repairs will be required within 3 years. No allowance has been made as yet for these.

Repairs to Crab Marsh quay will also be required and the cost of these are not budgeted for yet.

10): Potential impact of the council’s future transformation programme with associated savings.

“Further detailed work is required to quantify the scope of this programme and associated savings,” says the report.

11: Review of the recharge of staff time to Fenland Future Ltd (the council’s own business arm) to quantify potential revenue savings. Currently recharges of £125k in 2022/23 onwards have been assumed in the MTFS.

12: Commercial and investment strategy and future potential positive returns to the council

“Whatever impact the above issues may have however, there will remain a significant structural deficit for the council to address over the medium term,” says the report.

“The forecasts for the years 2024/25 – 2027/28 are provisional at this stage and should be considered with extreme caution.

“Future announcements and consultation outcomes will also determine government policy and therefore the funding in the future years.

“In addition, the forecasts are dependent on permanently maintaining the savings already identified through the My Fenland transformation initiative.”

The officers says apart from the risks associated with externally determined funding streams, the council should also ensure that income budgets are achieved.

“And new income streams considered and implemented for medium to long term sustainability in combination with any operational and transformational benefits that the council realises,” says the report.

“The use of general reserves to support revenue expenditure adds to the overall risks to the council as such reserves can only be used once but the cumulative impact of such use will continue to be felt into the future.”

The officers add: “The motion agreed by council emphasised that 0% increases in Council Tax throughout the MTFS period is an ambition.

“It was recognised that the council continues to face significant financial challenges and uncertainties that may not allow this ambition to be met.

“These challenges and uncertainties had been exacerbated by Covid19.”

Opinion: Could Fenland’s council tax cut be a political ploy to buy our vote? https://t.co/FBnNx6XNdn

— POLITICAL HEDGE (@politicalHEDGE) February 18, 2023

They add: “A Council Tax reduction of 2% for 2023/24 is, ultimately, a political decision for full council to make if it should so decide, just as a continued freeze or even an increase in the Council Tax level for 2023/24 would be for full council to decide.”

They reminded members that they “need to act responsibly each year when setting the precept to balance the ambition of achieving a medium-term 0% Council Tax rise with the legal need to balance the budget.

“It was agreed that raising Council Tax in any of the next four years would be a last resort in order to minimise the financial effects of Council Tax on all of Fenland’s households.”

A 1% increase in Council Tax in 2023/24 would have generated in the region of £81,000 of revenue per annum to the council.

“Even with this additional revenue included the estimates by 2027/28 show a significant shortfall.

Voluntary Council Tax contributions

The council is also looking at options to introduce a scheme to accept voluntary Council Tax contributions from residents whereby they can pay an additional amount over and above the ‘normal’ amount of Council Tax.

“Officers are working through some of the technical challenges involved in implementing this with an expectation that a scheme will be introduced in next year’s budget, with Fenland’s museums being the currently suggested beneficiaries,” says the report.

Cllr Chris Boden, leader of Fenland District Council and Cabinet member for finance, said: “At a council meeting in July 2019 it was agreed that raising council tax in any of the next four years would be a last resort in order to minimise the financial impact of council tax on all of Fenland’s households.

“This year we want to go further and are proposing to cut Council Tax by 2%.

£2m expansion of #Chatteris business park pulled by @FenlandCouncil and matching funds returned to @CambsPboroCA #Fenland #Cambridgeshire #businessnewshttps://t.co/Xw1fUIoXZw

— John Elworthy (@johnelworthy) February 15, 2023

“We are one of very few councils in the country with a council tax record like ours, and we are incredibly proud of the fact that, thanks to good financial management, we’ve been able to achieve this while still delivering excellent services for local people.”

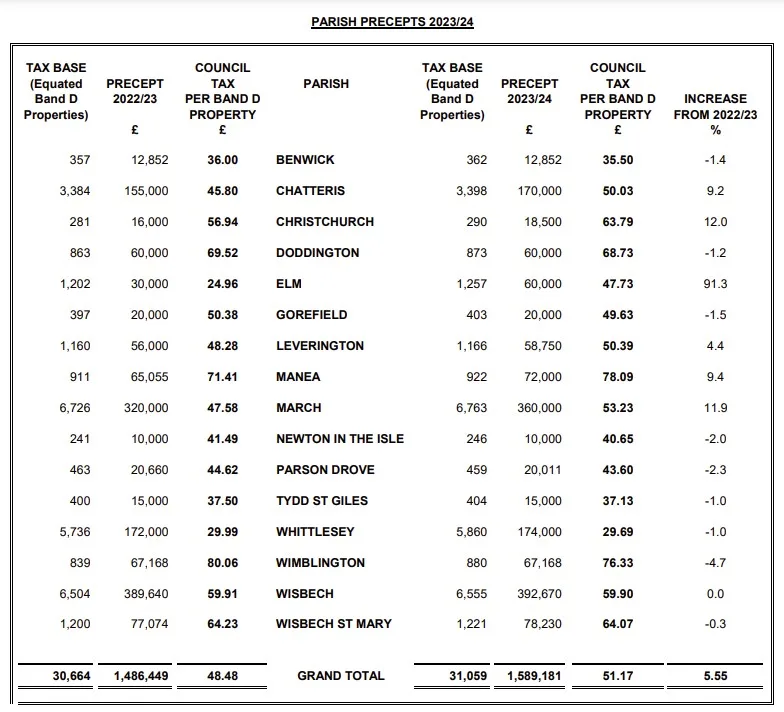

Cllr Boden said residents would still see a rise in their overall Council Tax bill due to increases from other precepting authorities, including a 4.99% rise from Cambridgeshire County Council (including 3% for the adult social care precept and 1.99% on the general council tax).

'Local government in Cambridgeshire needs a major overhaul and re-organisation, the current proposal to levy a Combined Authority precept of £12 for buses highlights the point' #OPINION #Cambridgeshire #Fenland #LGA#Chatteris .https://t.co/wAmc9JtwOP

— CambsNews.co.uk (@CambsNewsOnline) February 10, 2023

There is also a 5.80% rise from the Cambridgeshire Police and Crime Commissioner and a 6.60% rise from Cambridgeshire Fire Authority.

Cambridgeshire and Peterborough Combined Authority has also agreed a precept for the first time in 2023/24, resulting in a Council Tax level of £12 on a Band D property.